Elaine Bannigan’s Pinnacle Report: Wellesley has double the single-family homes on the market from one year ago

Elaine Bannigan of Pinnacle Properties has for the past 24 years put out The Pinnacle Report, a regular, data-driven look at residential property sales in Wellesley. The following Report examines 2025 residential property sales in Wellesley year-over-year from 2024. Here’s what her data crunching has revealed:

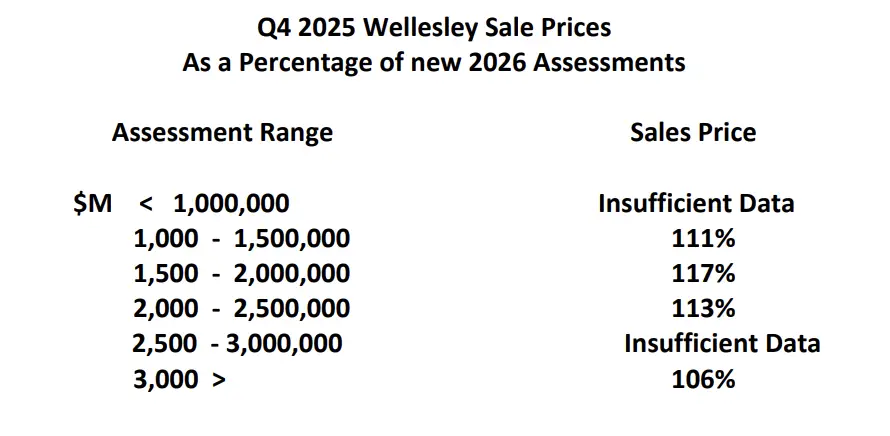

An initial statewide snapshot or property sales is an interesting starting point, but I always underscore that data varies from town to town and one price range to another. The overall Massachusetts single-family median price rose roughly 4% to $670,000 and the transaction volume rose roughly 3%. The condominium median was completely flat at $550,000 while volume rose just 2%. Here’s what happened in Wellesley in 2025:

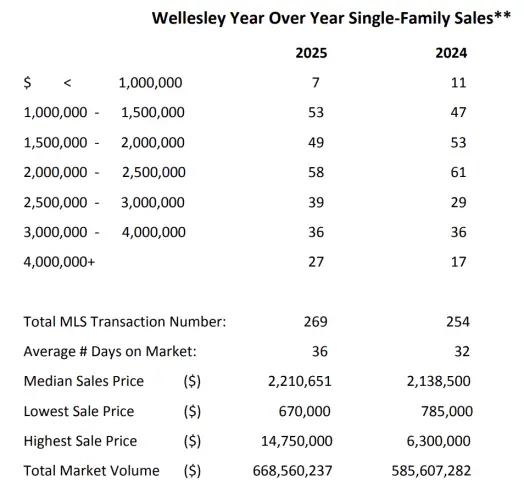

Wellesley single-family homes

In 2025, the supply offered in MLS increased 4% (but not of homes priced under $1M), and the total number of MLS sales increased 6%. The median rose 4%, but homes were on the market a few days longer, and the sale price to original list price ratio dropped 2%. At the top of the luxury market, the number of sales jumped from 17 in 2024 to 27 in 2025. Our median sales price is now at $2,210,652.

This year, the data from both MLS and town sales records had to be examined and scrubbed carefully. Some real estate agents placed condominiums under the MLS single-family category and some 2025 sales had not yet been entered into the Town of Wellesley’s data base.

Supply and 0ff-market (Non-MLS) sales

Over the year, there were 331 single-family homes offered in MLS and 269 of those sold. In general, buyers more carefully weighed their options and evaluated prices. Fewer buyers dropped the very important inspection contingencies.

There were another 48 off-market single-family sales (that’s up from about 3 to 5 just a decade ago), so the actual total number of homes transacted was 317. Mid-to-higher range off-market transactions often involved real estate agents who did not offer the property to all qualified buyers. Those sales prices don’t fit the definition of ‘fair market value’ and their numbers are never included in the center table. In the past, I’ve provided data showing that homes tend to sell for more when listed in MLS. Homeowners who are considering selling should note, if you don’t want unqualified buyers viewing your home, that’s perfectly understandable. You can instruct your agent not to have open houses for the public. You can also restrict online photography to just rooms on the first level, or none at all. There are many ways to offer your home with more discretion if that’s your requirement, yet still ensure that reliable news of its availability reaches all those who might offer you signficantly more with optimum terms. Your privacy does not have to come at the expense of selling your home for less than fair market value.

While bone-chilling weather has most likely postponed some listings, as of January 31 there are 29 single family homes on the market—roughly double that of one year ago.

Local condos and townhomes

There were just 43 sales of condominiums this year versus 80 in 2024. That’s due to the 2024 completion of the town’s newer luxury developments. In 2024, 36 units closed for more than $2M vs. just 10 in 2025. It is reflected in a median drop of 20% to $1,445,000. This has absolutely nothing to do with appreciation or depreciation; it’s just an indication of in which price ranges sales occurred.

The market absorbed most of the supply over the last two years, and the condo inventory is down to just seven homes—exactly half that of one year ago.

The following sales data for single-family properties was extracted from the Greater Boston Multiple Listing Service and includes the majority of fair market value sales in Wellesley. Non-MLS sales do not necessarily represent fair market value, as those are properties that were not fully exposed to the open market.

**Closed MLS sales transactions from January 1 through December 31.

Optimism for 2026

Two key considerations for the 2026 housing market remain interest rates and supply. The lower rates have not only increased affordability for buyers, they have enabled more people to give up their low rate of five years ago to trade up, down, or out. Lower

rates should also encourage new construction loans.

Data recently cited by the National Association of Realtors (NAR) states that of the three major factors that influence the market— lower interest rates, stabilized home prices and an increase in supply—the interest rate reduction is the main driver for a recent 3.3% jump in pending home sales, the highest level in nearly three years.

Inventory shortages have driven home prices up for a long time, but supply has started to increase due to a number of factors, one being the first of the Boomers have turned 80. Since they own 40% of all U.S. real estate, I expect the supply will begin a more steady increase.

Demographic shifts

NAR’s Profile of Home Buyers and Sellers also states that today’s housing market is being shaped by older, more experienced buyers. The median age of repeat buyers has climbed to a record high of 62. That’s a shift from 10 years ago when the median age was 52. The data shows these older consumers are selling their existing homes in order to ‘right-size.’ When buying their next home, they prefer suburban locations and senior-targeted properties. The age of first-time buyers has also climbed from just 32 ten years ago, to 40. While interest rate reductions help them with affordability, their biggest challenge is saving for that hefty down payment.

(As for the President’s pledge to ban large investment firms from buying single-family homes, this would have no impact on neither housing affordability nor supply in our area. These major investors own only about 1% of the single-family homes in the country, and those homes are primarily in the South.)

For more information, or for a complimentary and confidential market analysis of your home, please call Elaine Bannigan at 781.710.3993.