Wellesley keeps single tax rate—and that rate has dropped

In the Wellesley Select Board’s annual least dramatic vote, members by a 5-0 count agreed that the town should stay with a single tax rate that applies equally to residential and commercial property owners. A split rate could give residents a break, but would significantly up the rate for commercial property owners in a continued challenging business climate.

Wellesley’s Board of Assessors, led by Chair Stephen Burtt, shared the numbers up for consideration with the Select Board and public on Tuesday, Nov. 5 (see Wellesley Media recording). Following approval of “a residential factor of 1.0” (in tax terminology) by the Select Board, the state’s Department of Revenue gets its turn.

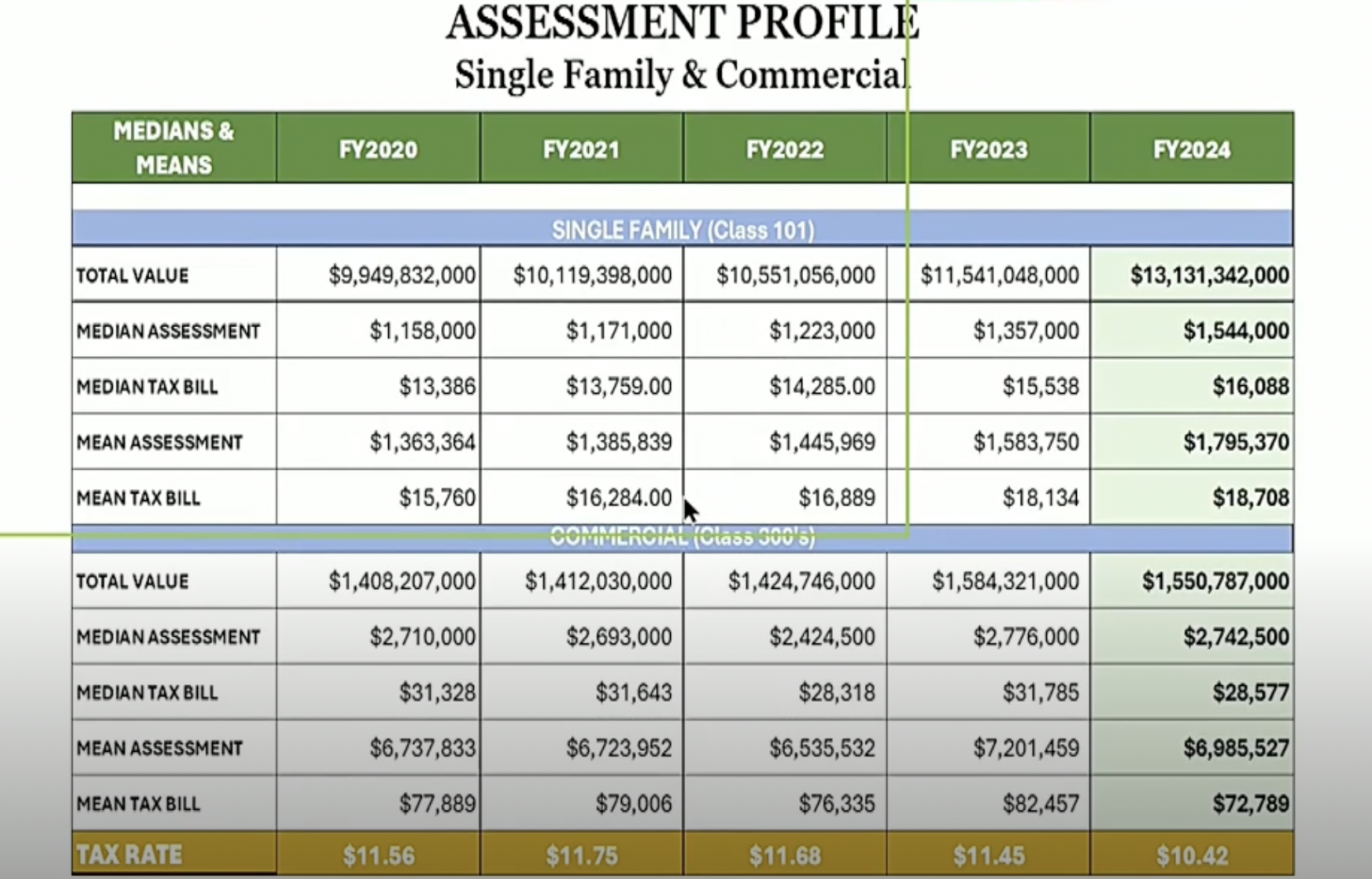

The biggest eye-popper among many eye-popping numbers shared is that the tax rate for Fiscal Year 2024 has fallen more than a dollar from $11.45 per $1,000 in property value to $10.42. That’s the lowest since 2009. In recent years, the rate has inched up and down by not more than a few nickels. Burtt says his research shows Wellesley’s rate is one of the lowest in Greater Boston.

If you’re a residential property owner, don’t get too excited as far as your tax bill will go. With the town’s Department of Revenue-approved property assessments continuing to rise, median tax bills for residential property owners will again soar. You’ll get smacked with a nearly $500 annual increase from a year ago if you’ve got property assessed in the area of $1.4M, the median single family property value in town. Though the increase year over year is 3.5%, merciful vs. the 8.8% increase between FY22 and FY23. The median tax bill is now up about $2,700 in just the past 5 years.

The median commercial property tax bill will fall for the second time in three years.

The town’s assessment team uses an elaborate and market-driven approach to analyzing values, explained Board of Assessors member Arthur Garrity.

Overall, some 88.69% of the total assessed value of properties in town for FY24 is residential (single-family homes, condos, apartment buildings), and that percentage could go higher in years to come given the pace of new multifamily developments underway or proposed in town. Because of the current lopsided residential-commercial split, changing the rate to give residential property owners say a $1,000-a-year break would boost median commercial tax bills by some $14K a year, Garrity said.

Select Board Chair Tom Ulfelder said he doesn’t take lightly the burdens on residential taxpayers during an inflationary period, but that the impact of going with a split rate on commercial property owners would be “disproportionate to the extent I don’t think it’s the best move for the town.”

Fellow member Beth Sullivan Woods said she’s strongly in favor of the single tax rate, noting: “I don’t think our small, village retail environment is the type of composition in town that affords a split tax rate… We don’t have a big industrial, very large business base that would make it more of a discussion.”

Member Colette Aufranc added: “It makes no sense at all to have a split tax rate.”

A bit under a third of communities in the state have split tax rates, per the Commonwealth’s Division of Local Services.

The Board of Assessors’ presentation not only shines light on upcoming residential and commercial property taxes, but also the budget that the town will have to work with based on the levy from property taxes, Proposition 2.5, remaining debt exclusions, new growth, etc

We spared you from watching the whole tax rate discussion. Please consider supporting Swellesley.